Back to blog

Education

August 21, 2022

Big Ed, Too Big To Fail

I received my first glimpse of the impending higher ed crisis shortly after I was appointed president of New Saint Andrews College. Like previous academics suddenly thrust into administration, I was eager to get a better handle on the business side of things. So I attended a conference to hear from the president of a small, historic liberal arts college who walked a group of other presidents through the higher ed business model. He plotted out the basic financial strategy, broke down how the funding works, and described where the money comes from. The more he talked, the more it became evident that the model he was describing was broken and unsustainable. He pulled no punches on its flaws. The talk was made even more odd and disheartening by the fact that he provided no alternatives or solutions. Instead, he humorously concluded with something along the lines of, “So you can see from this that we are all driving straight off of a cliff, and there is no way to turn.” With that, the room erupted into laughter, and the talk ended. Having acknowledged impending doom, we retreated into the hall for casual conversation and snacks.

In an upcoming report from Bain and Company the authors point out that nearly 33% of all schools are struggling and that 49% of public universities are on an unsustainable financial path. More and more people are pointing out the flawed model, like in this piece by Jason Wingard, president of Temple University. That said, many in higher ed leadership—and too many of the institutions they run—are on autopilot, hurdling toward an inevitable economic failure with no plans to change course or do anything to prepare for what’s coming. Much of this might be because the current higher ed leadership team will just bail when things get bad. With pensions and retirement plans in hand, they can sail into the sunset and leave the problem to someone else. And perhaps more importantly, change doesn’t happen because American higher ed is so heavily subsidized by federal student loans that nobody really sees a way out of the mess.

Consider one of the major lessons from the financial collapse of 2008-2010 (the Great Recession). The meltdown was largely driven by the subprime mortgage crisis when banks pursued terrible lending practices and the feds essentially encouraged it. Banks would lend huge sums of money to people that had no business buying houses, countless people defaulted on those loans, and, eventually, the system came crashing down, taking the entire economy with it. Many of the financial institutions involved knew that what they were doing was wrong and unsustainable, but they were making money, and everyone seemed happy to keep going along with the scheme, willfully ignorant of how bad the entire deal was. One could imagine that a fair number of college boardrooms must feel a little bit like Lehman Brothers before the collapse.

Here we find one of the darker sides of higher ed. The entire system is feeding at the trough of federal taxpayer dollars. The business model behind this lending is highly flawed and has cost taxpayers billions more than we were told it would. This would explain why a group of college leaders can be in a room, laughing about how poor their financial models are, without any real sense of impending doom. Yes, they get what they’re doing doesn’t really pencil. But they also get that they’re backed by the same sort of too-big-to-fail hubris that poisoned the financial sector. Such corrupt, bureaucratic, handout thinking has become all too common in our culture. We’ve even named these types of industries accordingly: Big Tech, Big Finance, Big Pharma, and Big Eva.

To this list, I'd like to add Big Ed.

Big Ed is that quintessential institution of higher education. Big Ed is convinced that America cannot exist without it, and no matter what level of irresponsible spending it indulges in, the American government will swoop in to supplement revenues and make sure that the checks never bounce. The disaster looming on the horizon doesn’t scare Big Ed because it doesn’t believe America would ever let Big Ed actually go over that cliff. Just look at the countless checks cut to American colleges and universities throughout the COVID crisis to make sure that the collapse of the economy wouldn’t touch Big Ed.

Over the past eight years, I’ve gotten a close-up look at Big Ed. Now, I’d like to unpack what I’ve learned and observed. In particular, I’d like to approach this topic, not just as a college president, but as the president of a distinctively Christian college. I think it’s tragic that Christian colleges are not resisting the pack of colleges driving towards that cliff, but are oftentimes leading the pack! So, in this series, I plan to walk through what I have come to understand about how higher education is broken and what it would take for us to fix it. With this first post, I’ll begin with the low hanging fruit: the financial model of the typical institution of higher education.

The Higher Ed Landscape

There are just over 17 million students enrolled in U.S. postsecondary institutions. A majority of those students (12.4 million, or 73%) attend public universities. Another 4.5 million (27%) attend private institutions. Total postsecondary enrollment peaked in 2010 and has been in a steady decline ever since. From the fall of 2019 to the fall of 2021, over one million students left American colleges and universities—a 6.6% enrollment decline in just two years.

A Flourish chart A Flourish chart

Lockdowns, school closures, forced masking and vaccinations, online learning, and labor shortages have all caused this precipitous decline. And this is all happening as the U.S. population has peaked and will start to fall dramatically over the next 100 years. The implications for Big Ed are massive. The nation has hit a well-reported demographic cliff, which means that the demand for higher ed will decrease significantly over the next few decades. These looming population and enrollment declines are already causing people to wonder if we really need so many schools. There are over 4,000 colleges in the Untited States, and all of them should be standing up and taking note of this shift. But oddly enough, the issue keeps getting swept under the rug. Big Ed doesn’t like to be noticed, questioned, or changed when it comes to its model.

Today, American colleges and universities aren’t tightening their belt, reducing staff, or having frank conversations about scaling back. If anything, they’re as committed as ever to building, staffing up (especially when it comes to administrative roles), and pushing tuition up to record highs. And this defies basic economics. With a dwindling supply, how can the system sustain more demand? I can guarantee that when things start to hit the fan, these same schools will be clamoring for a federal bailout and takeover to ensure that “America’s youth” can get access to higher ed.

American higher ed, public and private, is a highly decentralized, scattered, complex, and confusing federal program. To illustrate, we’ll take a closer look at how public university systems generally work.

The Public University Business Model

Large public universities receive a significant amount of their financial support from their respective states. Many of them were founded by state governments at the end of the eighteenth century and throughout the nineteenth century. The first public universities were the University of Georgia (1785), UNC Chapel Hill (1789), and the University of Tennessee (1794). These state schools were established in order to compete with the private college system, which was well established in the north and generally originated with churches or church-affiliated organizations.

Land grant universities like the University of Idaho (1889) Washington State University (1890), and Oregon State University (1868) came much later, when the federal government passed the Morrill Act (in 1862 and 1890). The Morrill Act promoted the study of agriculture and engineering to support the infrastructure of the young, growing nation. They also transferred parcels of federal land to state governments (hence the phrase “land-grant universities”), which the state governments could use to fund the establishment of their own state universities.

State universities have become, by far, the most popular choice for college-bound students. One of the main reasons for this is the cost. State governments significantly underwrite the costs of studying at these schools. For instance, according to SHEEO, a typical state university (in 2018) received $7,853 per attending student from their state and local governments. This explains why state universities have two rates for tuition and fees: one for in-state residents and another for out-of-state residents. The out-of-state residents get a higher price because their families haven’t been giving tax revenue to that state. However, the actual amount of funding can vary quite a bit as you go from state to state. Vermont and New Hampshire give less than $3,000 per student, since so many of their students end up at private colleges. But Wyoming, where oil revenue has been overflowing the state coffers, gives the state colleges a luxurious $18,000 per student.

The second important ingredient to the state university budget is tuition revenue. In 2018, the average student at a public university paid $6,788. This number has been steadily climbing over the last decade. For instance, in 2008, the average tuition payment was $4,898 (in constant adjusted 2018 dollars). Of course, this figure also varies significantly from state to state. In Vermont, where state contributions were minimal, the average 2018 student tuition payment was $14,907. In Wyoming, where that state is carrying $18,000 per student, the average tuition payment was only $3,801.

So, if the average state contribution is $7,853, and the average individual student pays $6,788, it would appear that, even at our public colleges, the individual student is still picking up 46% of the tuition. However, the tuition payment from the student is actually a little more complicated than that. Included within the tuition number are all the various forms of federal financial aid, the primary components being Pell Grants and federally subsidized student loans.

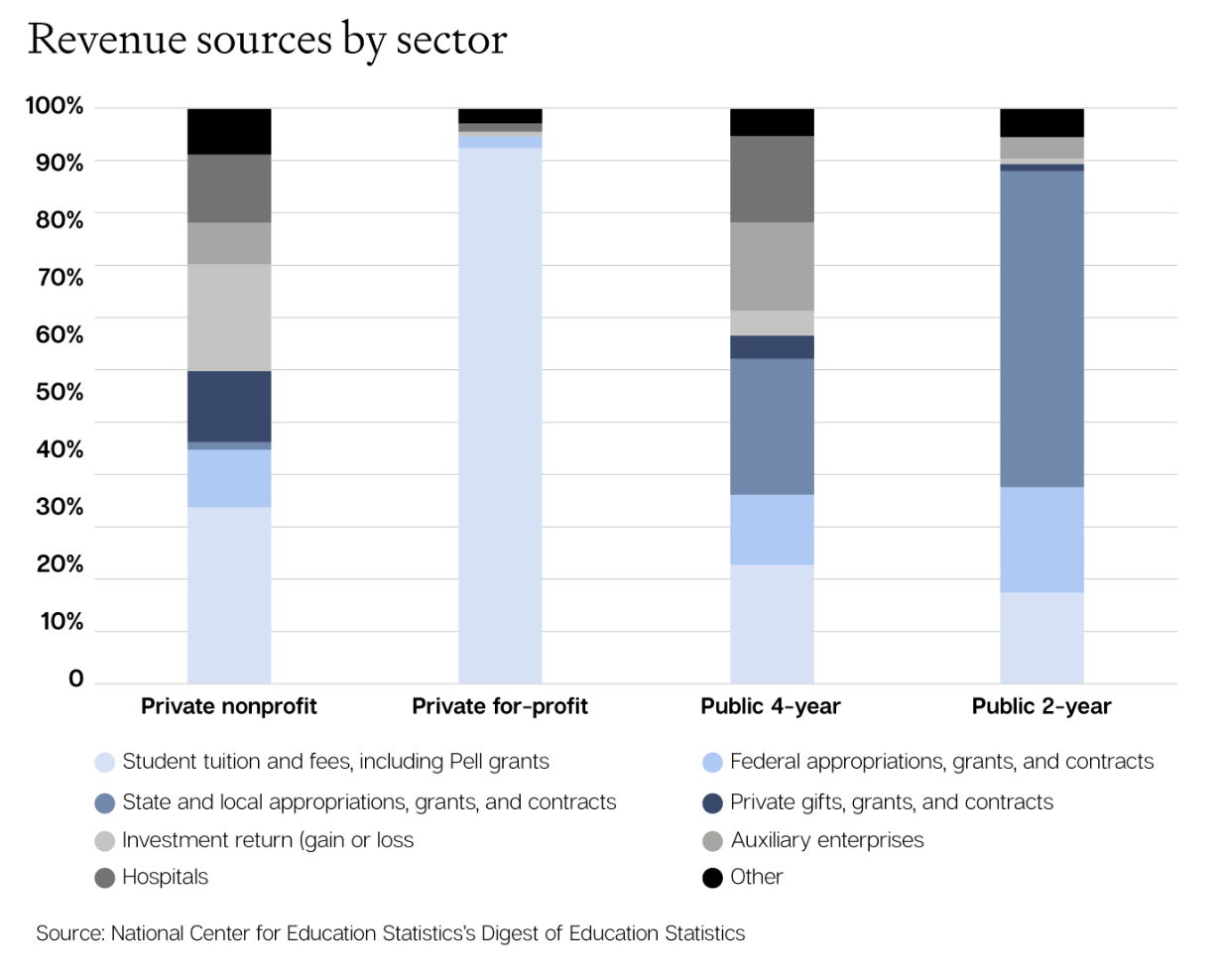

A Pell Grant is awarded to the individual student as a need-based grant. From the university’s perspective, this money comes as a tuition payment from the student, but in actuality, this is money coming from the federal government. In the 2017-18 school year, the average Pell award was $4,010 (the maximum allowed was $5,920). On top of Pell Grants are student loans, which are also subsidized by the federal government. Today, 65% of graduates leave college with student loan debt, with the average balance per student being over $37,000. In 2022, student loan debt has ballooned to $1.76 trillion, which is just staggering. These dollars are, of course, spread out across all U.S. colleges, not just the public universities. What is most notable is that once you add up all the money that the federal government gives directly to postsecondary institutions each year (both public and private), the total is actually greater than what all the state governments collectively give. The cash payments from students or their parents, from their own pockets rather than from grants and loans, are the least significant contribution to the public university’s revenue stream when compared to the state and federal contributions. In fact, according to NCES, tuition and fees only make up 20% of public universities’ total revenue.

This is why so many colleges are not so worried about declining enrollment, shrinking demographics, and the overall trajectory of demand for higher ed. They’re funded by the federal government and feel almost no pressure to change that. It’s easy money, and it keeps flowing. To counteract enrollment declines, they merely have to boost tuition, encourage students to get loans, and let the federal government continue to pay for it all.

Conclusion

You’ve heard the saying – “If you take the king’s coin, you become the king’s man.” While we have always understood that the cost of state universities was somewhat underwritten by the government, I don’t think many people realize how extensively these colleges depend on government money. And this has significant implications for how these schools are run. For one thing, this is not a system that is tuned into the price signals of the free market. Rather, state universities are far more responsive to state and federal government budget allocations. There are, however, other problems, much greater problems, that come from having the reins of the nation’s institutions of higher learning so tightly gripped by a godless bureaucracy. But I don’t think I can develop these greater problems until I have further explained our financial mess. This really is a swamp and it takes a bit of trudging through before you can really understand what is going on.