Back to blog

Education

March 8, 2023

What's The Problem With Federal Loans?

If you, the attentive reader, are starting to suspect that I am not a very big fan of federal financial aid, let me confirm your suspicions and admit that I think it has been a bad business. Very bad. But let me first concede that federal aid has helped many millions of Americans (including myself) to fund their college experience. However, we often find that the benefits we have received from something in the short term are completely undermined when we discover the long-term harm brought by that same thing. A diet pill that effortlessly melted thirty pounds off of you in two weeks but also brought you terminal cancer in two years is not necessarily a great deal. I believe that the great good that has been done by federal financial aid has been undermined by the way the same money has been slowly destroying our colleges. In this and the following blog posts, I would like to argue that federal money has deeply compromised our colleges.

"I believe that the great good that has been done by federal financial aid has been undermined by the way the same money has been slowly destroying our colleges."

The Bennett Hypothesis

Incoming college freshmen are not the only ones who struggle to restrain themselves at the sight of the easy money from student loans. Colleges have swiftly raised tuition to capture the extra money now available through Pell Grants, but especially student loans. You must remember that colleges are businesses. We might be non-profit corporations, but that doesn’t mean that we don’t still desperately want your money. And one of the primary rules of business is — never leave money on the table.

For instance, if you come to buy a car from me, which I intended to sell for $5k, but I somehow find out that you actually brought $7k in cash and were prepared to spend it all, then guess what? The price just went up. Why? Because I don’t want to leave money on the table. If you have the ability and willingness to pay more, then I am going to adjust the price to capture as much revenue as I can in this transaction. We are currently seeing this exact scenario play out in the electric vehicle market. The Inflation Reduction Act of 2022 extended a tax credit to purchasers of electric vehicles. But as soon as it dropped, EV makers increased their prices at a rate remarkably similar to the credit total. (I’m not sure that is how inflation reduction is supposed to work.)

"There is simply no good justification for the steep climb in college tuition over the last several decades."

The same thing has been happening with college tuition. For instance, imagine a college applicant that can only pay $10k annually for college. But the federal government comes alongside to give that applicant an additional $4k in Pell Grant money and another $8k in student loans. Can you guess what the cost of college is now going to be? The answer is as easy as adding 10+4+8. The new price is $22k because the college doesn’t want to leave money on the table. And for private colleges, the practice of setting tuition ridiculously high and then discounting to meet the student wherever their federal aid lands them will allow colleges plenty of room to negotiate a discounted scholarship that does not leave any federal or family money on the table.

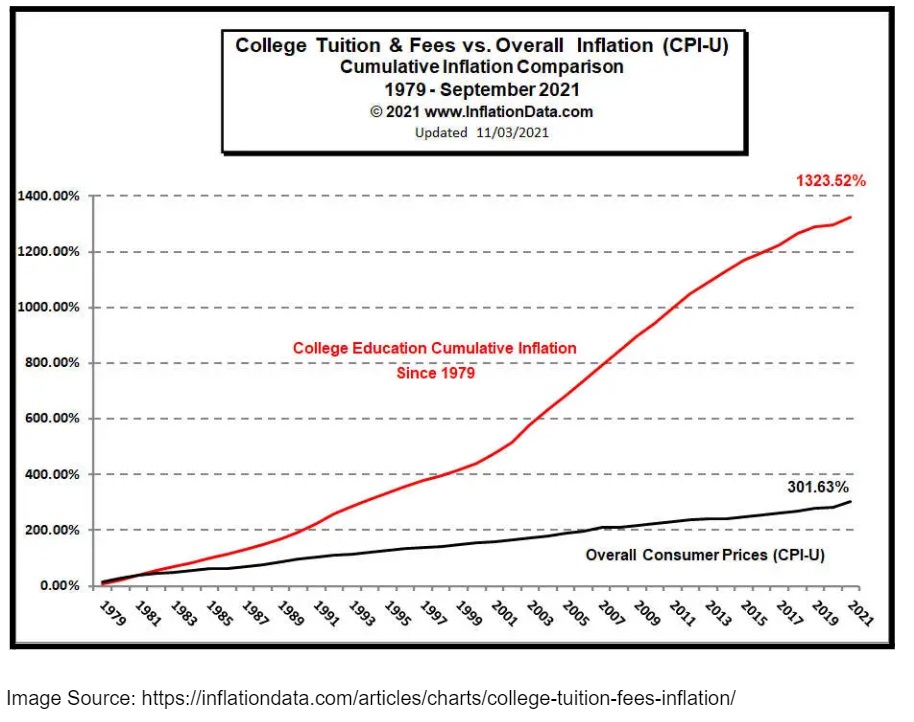

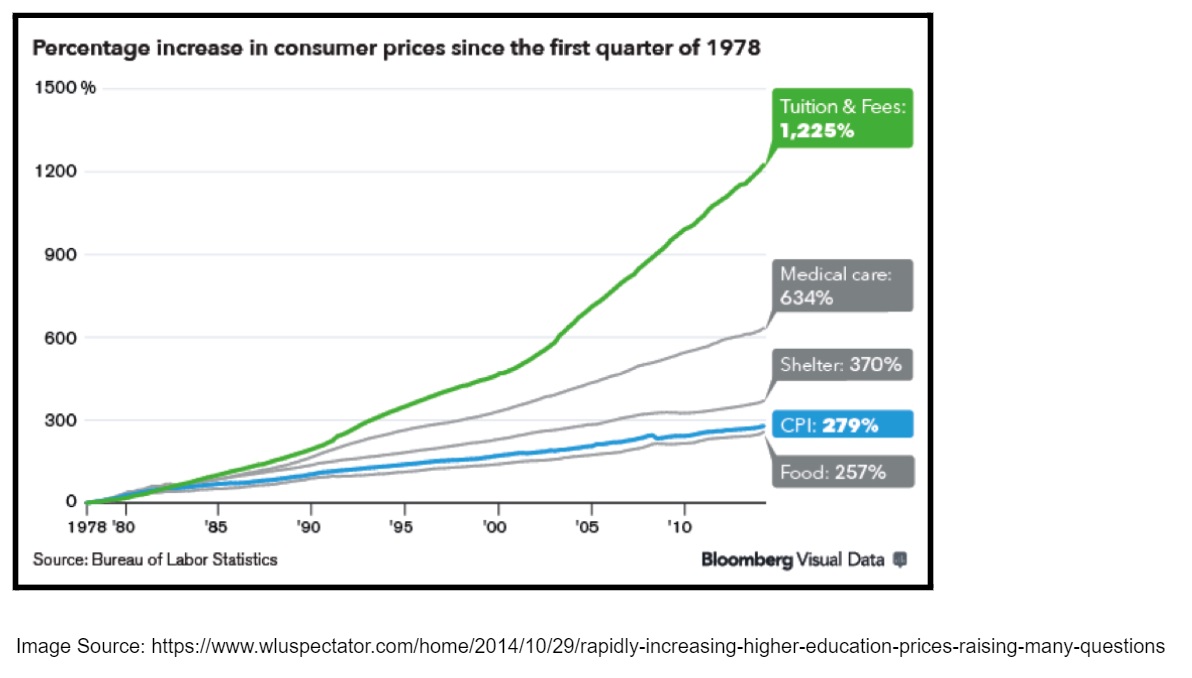

The link between federal money and the skyrocketing cost of college tuition is a very controversial subject among college presidents. They prefer to say, “Look, education is just getting more and more expensive to deliver. We are simply passing our costs on to the consumer.” However, this is not just standard inflation getting passed on to the consumer, since tuition and fees are increasing at a rate far faster than the rate of inflation.

There is simply no good justification for the steep climb in college tuition over the last several decades.

Or, consider another comparison — since 1985, the increased cost of attending college has doubled compared to the increased cost of health care. And while I think it is fair to say that health care has significantly improved over the last 35 years, I’m not sure that I could make the argument that college education has.

Colleges don’t like to admit it, but the fairly obvious cause of climbing tuition is not that education costs more to deliver, but that there is more revenue to capture. Federal aid is driving up the cost of tuition. This position was once advanced by William Bennett, President Reagan’s Secretary of Education, and is often referred to as the “Bennett Hypothesis.” To quote Bennett, “If anything, increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that Federal loan subsidies would help cushion the increase. In 1978, subsidies became available to a greatly expanded number of students. In 1980, college tuition began rising year after year at a rate that exceeded inflation.” Subsequent decades have proved Bennett right. A recent study by the Federal Reserve Bank of New York demonstrated that for every dollar of subsidized student loan offered by the government, the market would respond by elevating tuition by 60 cents.

In the end, the federal money, rather than making college more affordable, has greased the skids for runaway tuition hikes.